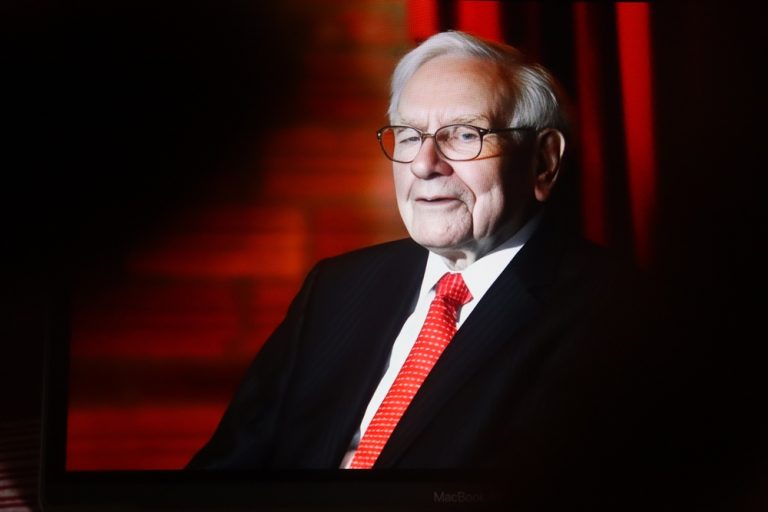

Warren Buffett, the 94-year-old investment legend known as the “Oracle of Omaha,” has decided to step down as CEO of Berkshire Hathaway, ending a remarkable 60-year tenure. Buffett revealed his decision was influenced by the physical effects of aging, including challenges with balance, occasional memory lapses, and changes in his vision. Despite these personal challenges, Buffett remains mentally sharp and committed to his investment decisions.

Buffett Reflects on Aging and Transitioning Leadership

In a recent interview with The Wall Street Journal, Buffett shared that he didn’t begin feeling his age until about 90. “I didn’t really start getting old, for some strange reason, until I was about 90,” he remarked. He described the experience as irreversible, highlighting moments like losing his balance or struggling to remember names. Despite these difficulties, Buffett remains confident in his decision-making abilities and his leadership at Berkshire Hathaway.

The End of an Era at Berkshire Hathaway

Under Buffett’s guidance, Berkshire Hathaway transformed from a failing textile company into a global conglomerate with a diverse range of holdings, including Geico Insurance, BNSF Railway, and multiple other large companies. Now, as Berkshire Hathaway’s stock approaches a record high, Buffett’s legacy as a visionary leader remains intact, leaving the company with a market cap close to $1.2 trillion.

Greg Abel to Succeed Buffett as CEO

Berkshire Hathaway’s board has unanimously selected Greg Abel, the current vice chairman of non-insurance operations, to succeed Buffett as president and CEO on January 1, 2026. Although Buffett will step down from the CEO role, he will remain as chairman, continuing to provide strategic guidance to the company.

Buffett’s Continued Influence on Investing

Despite his decision to step down, Buffett expressed confidence in his ability to make investment decisions. He stated that he remains as capable as ever when it comes to making significant investment moves. Known for capitalizing on market downturns, Buffett noted, “I don’t have any trouble making decisions about something that I was making decisions on 20 years ago or 40 years ago or 60 years.” His ability to remain calm during market downturns is a hallmark of his investing philosophy, which is grounded in long-term thinking.

As Buffett prepares to pass the baton to Abel, his legacy of value investing, steady decision-making, and calm during market turbulence will continue to shape the future of Berkshire Hathaway.